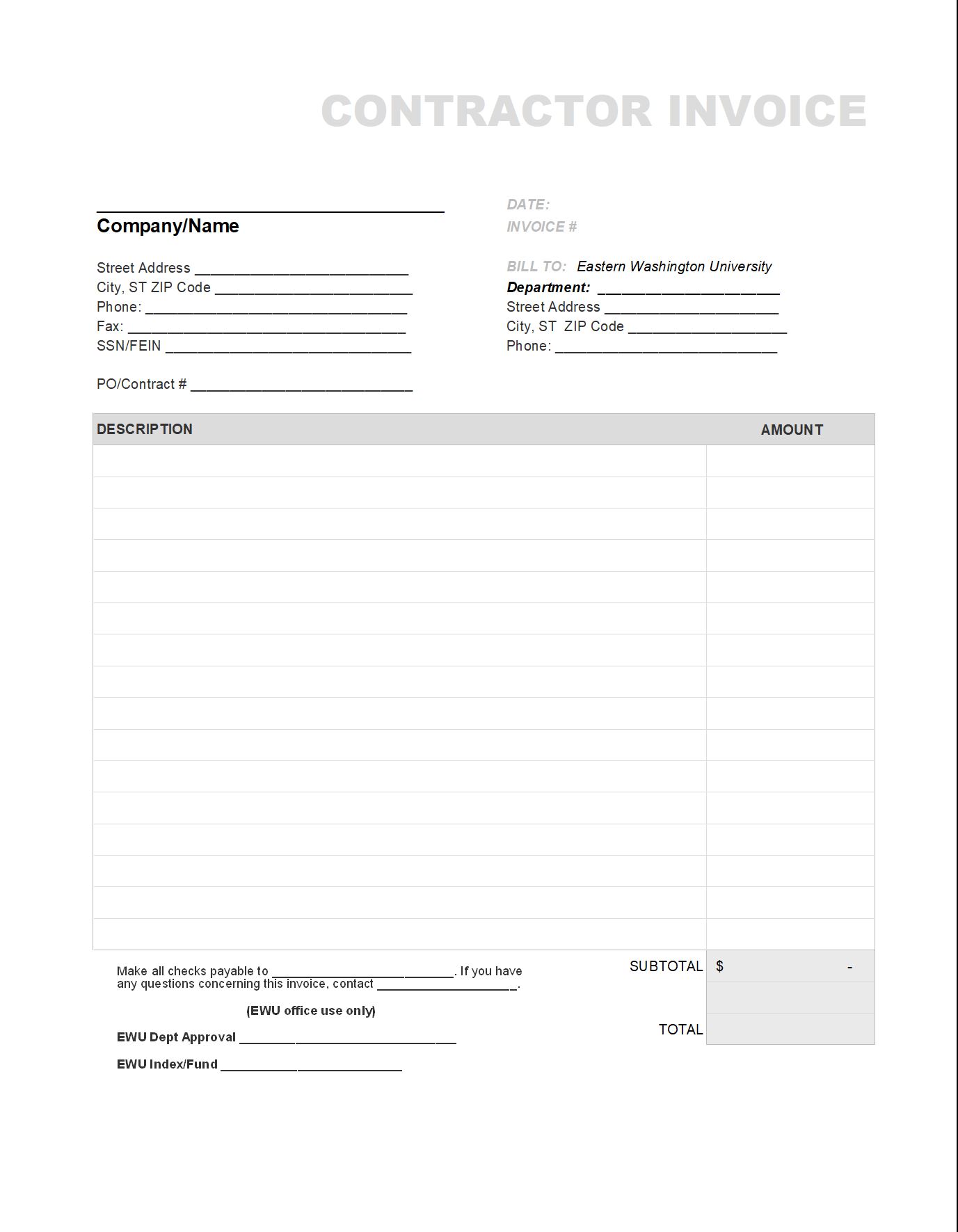

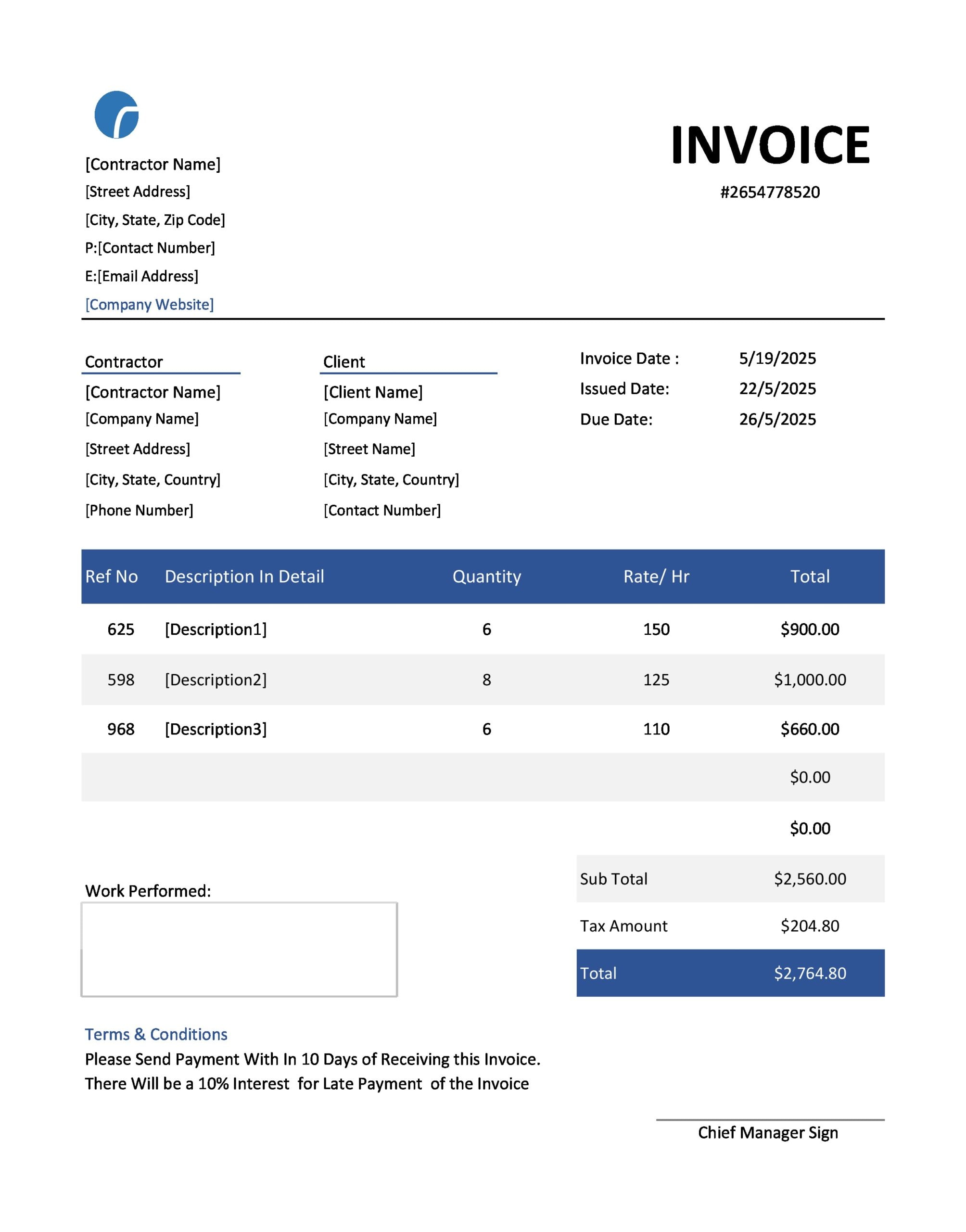

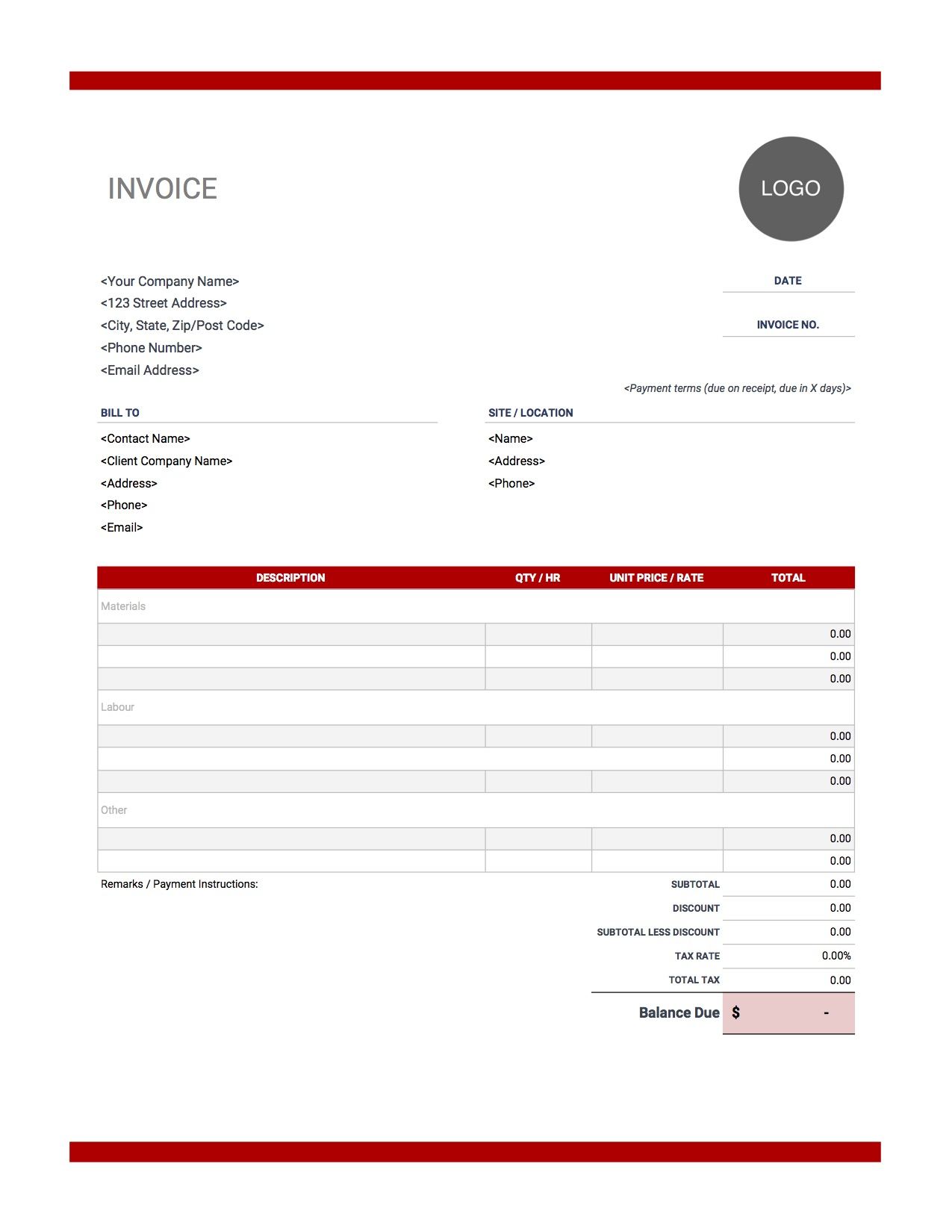

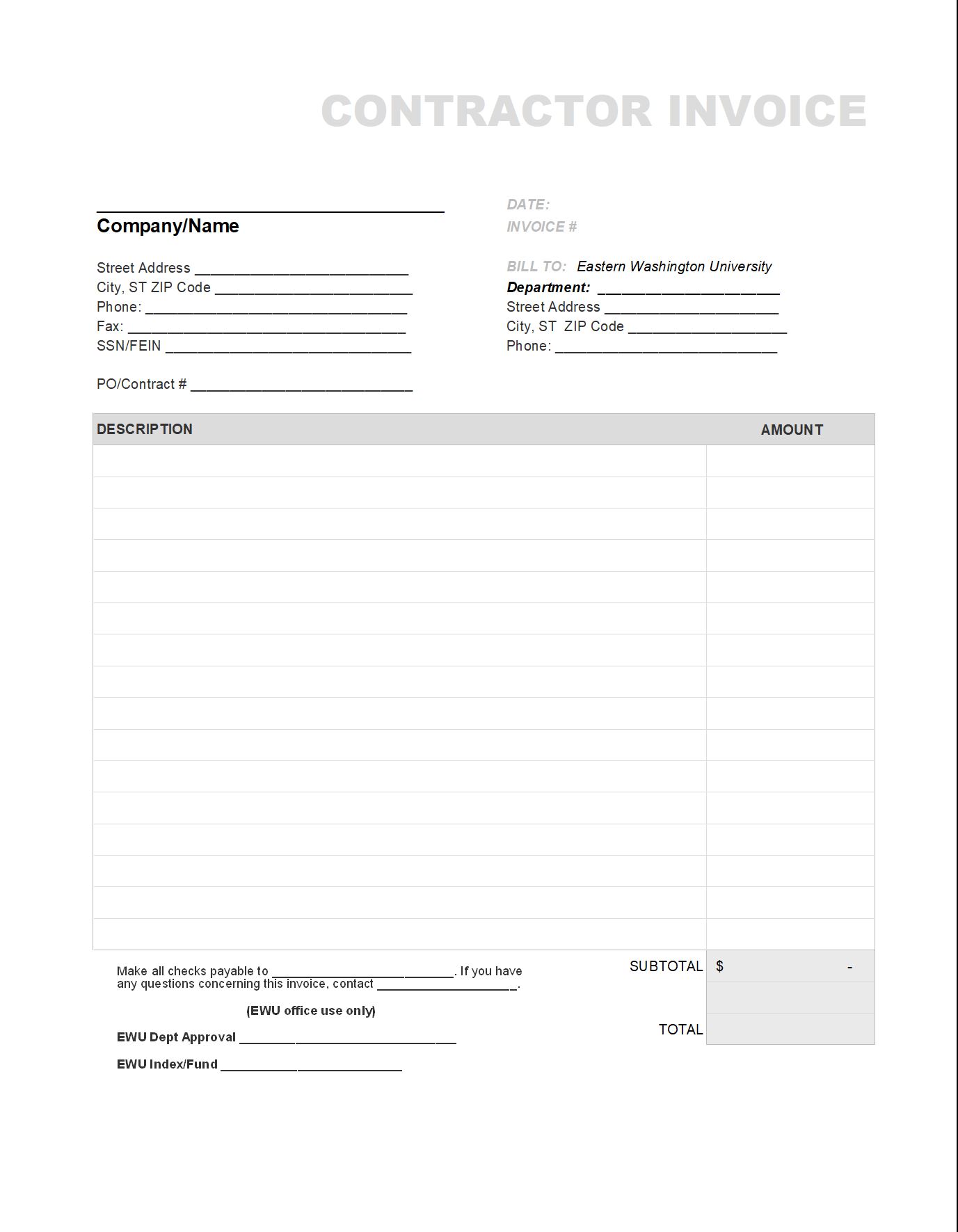

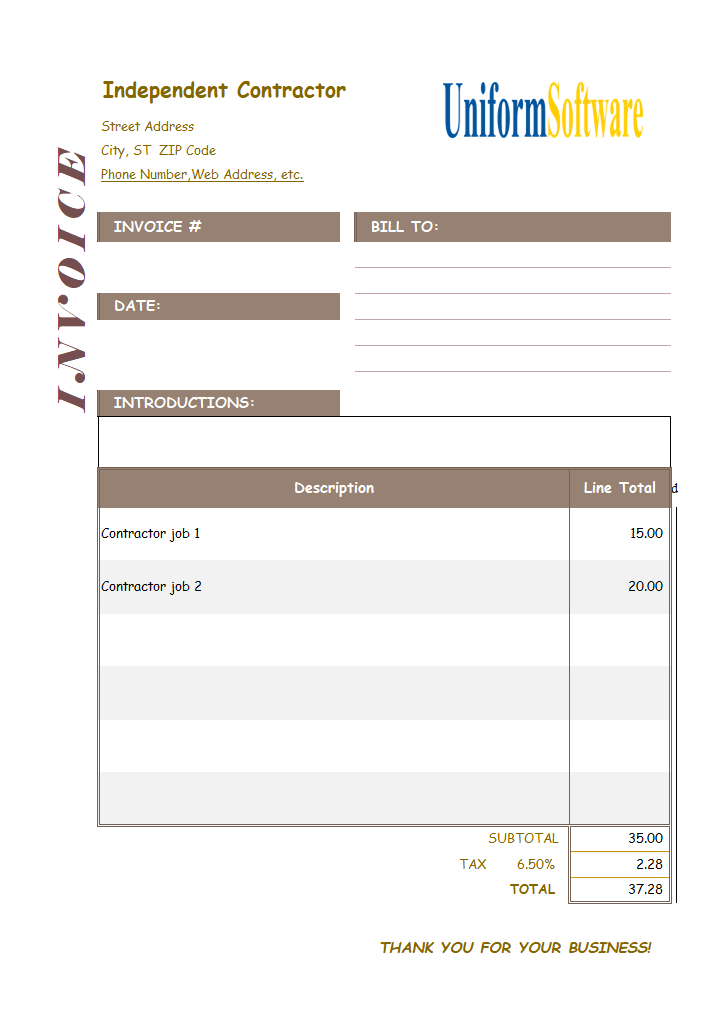

1099 Contractor Invoice Template

Maximize write-offs and estimate and save for 1099 taxes. Files IRS Form 1099.

Independent Contractor Invoice Template Word

General Contractor - Individual or construction company that is responsible for the oversight of the construction.

. How to Invoice as a Contractor. License Number - The general contractors state license number. Does not file any unemployment insurance.

If youre looking for a good template contract for an independent contractor. Any organization involved in the sale of real estate and certain royalty payments must use Form 1099-S. Free Estimate Templates Forms.

For e-delivery a company needs to have delivered the email to the recipient informing them that their form is. In many ways it would be much simpler if the IRS just issued a contractor invoice template and said Here you go everyone must use this. Work site - Where the construction is to be completed.

Seven Things to Never Say to a Contractor. You are not an independent contractor if you perform services that can be controlled by an employer what will be done and how it will be done. Self-employment tax payments being the responsibility of the subcontractor.

A 1099 form marks self-employment earnings for the IRS. Freelance workers cannot have employees but they can delegate work to other independent contractors. An invoice is a document used to itemize and record a transaction between a vendor and a buyer.

Enter all expenses on the All Business Expenses tab of the free template. The earnings of a person who is working as an independent contractor are subject to self-employment tax. What is an independent contractor.

As always the contractor proposal template also has a Invoice Manager for Excel version which you can download for free from the download page too. State the location. In fact if you know the person you are working with its even more important to use the proper contractor estimate formsAug 29 2020.

Durable Financial Power of Attorney Gives a caregiver the power to pay bills making deposits and providing the assistance needed to handle financial responsibilities on someone elses behalf. Web Design Invoice Template. 1099 Forms 1099-MISC Form 1099-NEC Form W4 Form W9 Form Blog.

Set a deadline so the client knows how much time they have to pay the contractor after receiving an invoice. When youre self-employed you are your own bosswhich is great news until tax time. 1099 Contractor Agreement.

How to Use this 1099 Template. You get a copy. Typically a business sends an invoice to a client after they deliver the product or service.

Then download your PDF invoice and send it to your client. The invoice tells the buyer how much they owe the seller and sets up payment terms for the transaction. The sale of your home will be reported on Form 8949 and Schedule D.

You dont need to do anything to your copy of 1099-MISC but if you dont receive one you should. Always get a minimum of three bids in fact the more bids you get the better. Even if you know a contractor personally a contractor estimate template is a form you can use to help define the parameters of a project.

Identify the total amount of each expense type by using the filter option on. The absence of any promise to pay for profit sharing pension paid holidays paid vacations insurance unemployment compensation or any other employment. If you received a 1099-S because of the sale of your primary residence then you should check the appropriate box on your Form 1099-S.

The typical time frame for payment is 15 to 30 days. Be sure to preview your invoice one final time to make sure everything looks good. Use this if you are a contractor and your boss doesnt give you checks.

If a freelance worker earns more than 600 from a company they will receive a 1099 form. Theyre required to file Form 1099-MISC and send you a copy of it. In addition to regular income tax freelancers are responsible for paying the self-employment tax of 153 in 2021This tax represents the Social Security and Medicare taxes that businesses pay and that employees have taken out of their paychecks automatically.

Fillable invoice SALESMAN. Project Description - A detailed description of the work and construction to be completed by the contractor. Using this pay stub template you can include invoice and client details as well as insert a table displaying the services performed and hours worked.

Contractor Invoice Template. The free construction estimate template or construction contract template has many static text labels on it which you must replace with your own text before you can create your first construction. Customize your invoice template.

Julio Juarez Great website. Form 1099-B stock or mutual fund sales and certain other transactions by brokers Form 1099-S proceeds from real estate transactions Form 1099-K merchant card and third party network transactions Form 1098 home mortgage interest 1098-E student loan interest 1098-T tuition Form 1099-C canceled debt. The contractors required provision of a 1099 form at years end for the subcontractors tax filing purposes.

Manage your money with a no-fee business account. With limited exceptions if you pay the IC 600 or more for services provided throughout the year you must provide him or her with Form 1099-MISCJanuary 31st is usually the due date that your company needs to have sent the 1099 form to its recipient. This will help you tremendously when comparing each contractor.

Paid after an invoice is issued. If you accept online or third party payments the financial institution reports this income to the IRS using 1099-K forms. There are 6 basic steps to using this 1099 Template.

1099-MISC is an information filing form used to report non-salary income to the IRS. Never Tell a Contractor They are the Only One Bidding on the Job. Separate each bid into the cost of materials and the cost of labor.

To find out what your tax obligations are visit the Self-Employed Individuals Tax Center. Free printable invoice template in multiple formats Use the free invoice generator to create customized invoices as many times as youd like. Using our template will ensure you complete the necessary steps.

You can find instructions regarding this legal requirement on the IRSs website.

Independent Contractor 1099 Invoice Template

28 Independent Contractor Invoice Templates Free

Independent Contractor 1099 Invoice Templates Pdf Word Excel

Contractor Invoice Templates Free Download Invoice Simple

Independent Contractor Invoice Template Invoice Template Word Invoice Template Contract Template

28 Independent Contractor Invoice Templates Free

Independent Contractor 1099 Invoice Templates Pdf Word Excel

Independent Contractor Invoice

Free Freelance Independent Contractor Invoice Template Pdf Word Eforms

Comments

Post a Comment